In this fascinating and fun conversation Rennie shared

- What “Shelter to Soldier” is, what it means to him (and why we both struggled to talk about it without crying) and how it’s his driver to keep going with Wealth on Any Income

- How he started his journey as a serial entrepreneur

- How he ended up broke at the age of 50, after 2 divorces and a business failure

- What he learned that helped him turn things around

- How he became a multi-millionnaire in just 7 years

- How he now helps other people understand money and generate wealth for themselves, on any income.

Enjoy!

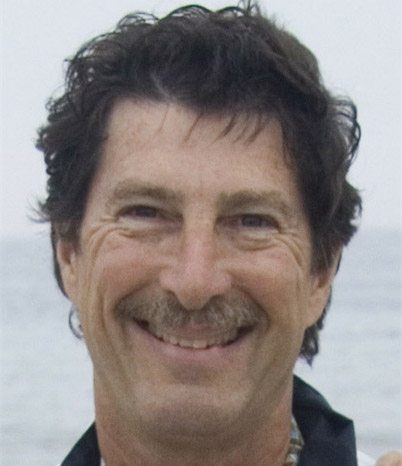

Meet Rennie Gabriel

Do you stress over money issues?

90% of the population has been taught nothing about handling money effectively, including CPAs and Financial Planners.

Rennie is a TEDx speaker and the author of the award winning, best-selling Wealth On Any Income. After two divorces and a business failure he was flat broke at age 50 and started all over from scratch.

After learning what was NOT taught from all his financial education he became a multi-millionaire in just a

few years. He has helped thousands of people avoid the financial downward spiral, and he can help you too.

Click HERE To Get the Treasure Vault of Free Tools Rennie talks about in the episode.

Get in Touch With Rennie

[email protected]

818-298-7555

www.WealthonAnyIncome.com

www.RennieGabriel.com

TEDx link: https://youtu.be/b2xWQl2B1U0

Facebook: https://www.facebook.com/WealthOnAnyIncome

LinkedIn: https://www.linkedin.com/in/renniegabriel

As always, if there is a topic you’d love me to talk about, or know someone who’d be a great guest, or you’d love to be a guest yourself get in touch, leave a comment below, contact me via email or social media. I’d love to hear from you!

Prefer to read?

Here is the transcript ..

Anke: [00:00:00] Welcome to the passion business podcast the podcast for free spirits with a big idea who wants to turn their passion into a business I’m uncle Herman And I’m your host My guest today is a TEDx speaker and he’s the author of the award winning best selling book wealth on any income After two divorces and at business failure he was flat broke at the age of 50 and started all over from scratch After learning what was not taught from all his financial education He became a multimillionaire in just a few years And he’s on a mission to help as many people as possible Find their wealth on any income You’re in for a real treat Welcome Rennie Gabriel Enjoy

[00:00:56] Hello and welcome Rennie. I’m excited to have you here.

[00:01:00]Rennie: [00:01:00] Thank you. And I’m excited to be here. Thank you, Anke.

[00:01:04] Anke: [00:01:04] Excellent. well, why don’t we start? And I’d love you to share with people where you based and what’s your business.

[00:01:13] Rennie: [00:01:13] Oh, sure. I’m in a little town near the coast in California. A lot of people have heard of it.

[00:01:19] I’m so surprised. It’s called Los Angeles.

[00:01:23] Anke: [00:01:23] Yeah.

[00:01:26] Rennie: [00:01:26] Yeah. Anyway, so, that’s where I’m based. As a matter of fact, I’m born and raised here.

[00:01:32] Anke: [00:01:32] Wow. And I’ve been there to visit once. It was just fascinating.

[00:01:39] Rennie: [00:01:39] You know, some people would say, Oh, you’re born in Los Angeles. You’re still there. You haven’t gone very far in your life and they’re right. Well,

[00:01:48] Anke: [00:01:48] that’s all relative.

[00:01:49] Isn’t it? So, so yeah. What’s your business? What do you do?

[00:01:53]Rennie: [00:01:53] I, the short hand is we raise philanthropists. We work with, coaches, authors, speakers, trainers, primarily heart-centered business people who. Have not learned how to handle money effectively, just like 90% of the population hasn’t. Yeah. And, they, they ha contribute to what touches their heart.

[00:02:18] And so we show them how to handle money effectively, make investments create a passive income, and it doesn’t matter if it’s in their business or outside their business, but that way. When their finances are secure and they’ve got additional funds flowing in, they can now donate money or their time to the causes that touch their heart.

[00:02:38] Oh, that’s beautiful.

[00:02:40] Anke: [00:02:40] And I mean, this is going to be audio only, but I can see what you’ve got behind their words. What’s the coolest that touches your heart. Cause you’re gonna make me cry.

[00:02:50] Rennie: [00:02:50] Oh yeah. And I I’ll try and get through it without making myself cry. sheltered a soldier is an organization that rescues dogs from high kill environments.

[00:03:00]and if they’re the right size and personality, they’re trained to service animals for soldiers. Who’ve come back with post traumatic stress disorder or traumatic brain injuries. And the statistics in the U S are that, of the returning soldiers, they’re committing suicide at the rate of almost one per hour.

[00:03:20]so, Not one service member who’s received their service dog has committed suicide. Wow. So, this organization is saving two lives at a time dogs that would have been euthanized and soldiers that otherwise could have committed suicide.

[00:03:36] Anke: [00:03:36] Oh, God, that is tough. Not to cry. Like I’m such a dog person.

[00:03:40] I’ve got three,

[00:03:41] Rennie: [00:03:41] I’ve got three rescue dogs at the house right now. Two more hours and one we’re house sitting. Yeah. We’re babysitting doggie sitting.

[00:03:51] Anke: [00:03:51] Yeah. So I’ve got, I’ve got three baskets and like two sitting my down here. Yeah. That that’s just so beautiful from all the, on all these different levels.

[00:04:03] Yeah. Yeah. So

[00:04:07] Rennie: [00:04:07] that’s what that does touches my heart. And so my wife and I have, w we funded nearly a hundred thousand dollars of their operations where they’re number five, a donor, and, you know, it just. It’s it warms my heart to, to them. So that’s what I do. And yeah. So the point is to raise other people to feel that same joy that we feel get out of the struggle that I had because, you know, it’s, I’ve gone through a lot of ups and downs as matter of fact, by the time I was age 50, I’d had two to forces and a business failure and it was flat broke.

[00:04:43] I had nothing to speak of and. I mean, if someone asks me to, you know, I had someone had a great investment and they only needed $3,000. It wouldn’t have mattered. I couldn’t have put that together.

[00:04:56] Anke: [00:04:56] And I think that’s all, that’s obviously what I was going to ask next. Like, huh? Well, like

[00:05:04] Rennie: [00:05:04] what.

[00:05:08] Anke: [00:05:08] To, to go out and start your own business to start with

[00:05:15] Rennie: [00:05:15] it was desperation. That’s what it was. Age 50. Yeah.

[00:05:21] Anke: [00:05:21] So did you start going out on your own at 50?

[00:05:25] Rennie: [00:05:25] No. I, the reason I’d had a business failure and a couple of divorces was because I’ve been a serial entrepreneur and some of them did okay. Some of them did well, some of them were abject failure. And so by the time I was 50.

[00:05:40] And, you know, with no resources and two divorces under my belt. and when I say a business failure, I mean, it nearly drove me to the point of bankruptcy. It was so bad. I had to collect soda, pop bottles, and cans to get the refund money, to buy food for my family. so you know, those don’t. Help keep a marriage stable, but you know, at age 50 it was the last straw from the standpoint I’m divorced.

[00:06:10]I, I, do you at least know how to coach other business owners to grow their businesses and be profitable. And I looked down the road and I said, Oh my gosh, You know, in 15 years I’ll be 65. And if I don’t want to be eating cat food, as, as my Neal’s, I’ve got to do something here. So I used a secret, that’s about 5,000 years old and it shouldn’t be a secret because the book, the richest man in Babylon has sold millions of copies, but it was the third time reading it.

[00:06:41] And I said, okay, Yeah, this is what I’ve got to do. And I paid my 10% of every dollar that came in and Hey, I wasn’t earning a lot of money like 5,000 a month. So I was setting aside five, $500 a month in three years. In three years, I’d saved up $18,000. and that’s really what turned things around because.

[00:07:05]my wife was a realtor and she knew a realtor and he had this little three unit property that he said, we should buy. And I said, well, you know, all I’ve got is $18,000. And he said, well, that’s 25% of the down payment. my wife came up with, another 18,000. He came up with the other half. And the three of us bought it and I’d taken a class at a UCLA.

[00:07:30] I think most people around the world have heard of that university on, it was through their extension school, how to manage apartment buildings. And so I was able to put it to use. And I took the class in the 1980s, and this was like 2001. And we, he cleaned up the property. We rented it, we fixed the items are highly fixed.

[00:07:52] A lot of the items that needed repair because we couldn’t afford, besides the down payment, we couldn’t afford to pay other people to do stuff. But in the, in about four years, that property increased in value by a half a million dollars. And I saw that this was turning out well, I borrowed more money to make down payments on more apartment buildings.

[00:08:15] And by a year five, six, seven, somewhere in that range, we had 50 apartment units that we owned and managed. So, you know, I went from flat, broke at 50 to a multimillionaire in about seven years.

[00:08:29] Anke: [00:08:29] Wow. Like, what really strikes me is that you started again, like at 50, which I find fascinating because people often have that.

[00:08:42]yeah, but it’s too late, you know? So there is the sense, especially when it comes to, I mean, when it comes to investing, I mean, apart from, I’d also love you to go back to like, because I agree that we know. Nobody really gets taught about investment. Right. So how come, like, what was that like for you when you grew up?

[00:09:08] Were you taught any of it or how did you know and that direction,

[00:09:12] Rennie: [00:09:12] you know, I, I I’m so glad you asked that such an excellent question. Cause not only did I not, was I not taught how to handle money effectively? I mean, I knew my mom. Spent less than she brought in. That’s about all I knew, became most frustrating to me, was getting an insurance license, becoming a chartered life underwriter, learning how investments work, becoming a certified financial planner and not one of those courses provided the foundations of how to handle money effectively.

[00:09:46] I mean, as a certified financial planner, I was helping people who already had wealth protected growth, but never are. We taught how to build it in the first place. As a matter of fact, I’m a certified financial planner or a certified public accountant. They’re not taught that information either. And it’s just, so when I say 90% of the population hasn’t been taught this I’m including CPAs and certified financial planners.

[00:10:14] I had no

[00:10:14] Anke: [00:10:14] idea that they didn’t, they didn’t really know either. I said, what do you thought? Yeah. That that’s, that’s incredible. So what, what made you curious to you? Because actually that’s a funny one because when I moved to Australia, because I’m married an Australian, his dad was quite savvy. And like, this was a whole new world for me.

[00:10:35] It’s like, what is he doing with, you know, investment units and this and that. And I was like, well, it’s this I literally, and I grew up in East Germany, like that’s that comes to my defense. Yeah. So, so how did you discover the whole world of, of investment?

[00:10:52] Rennie: [00:10:52] It was, I knew it existed. because as a certified financial planner, I had licenses and all this stuff, but again, the foundations were missing.

[00:11:02] How do you actually structure your life to spend less money than you earn? And that’s, I mean, I went through some. I went, I devoured books to try and learn this and, you know, while I learned it, I wasn’t able to apply it. And what I found out, you know, you can read a book, a great book. As a matter of fact, I’ve got a book it’s called, excuse me, I’m going to cough.

[00:11:33] My book is called wealth on any income and it is great, but I got to tell you, it doesn’t matter how great a book is. There are two things that cannot do no book can do this. It cannot interrupt your faulty thinking. Cause you keep it to yourself. And even if you share it with the book, the book can’t respond to you and say, Oh, I’m good.

[00:11:54] That’s not correct. That’s true. Okay. So the book can’t interrupt faulty thinking number one, and number two, the book cannot be an accountability partner to you that requires human being for both of those things. And so what I’m getting at is. There was no one that was holding me responsible for doing the things I might’ve learned from books.

[00:12:16] There was no one holding me responsible for doing the things I learned in my CFP coursework. There was no one who’s holding me accountable to make the kind of investments I learned about. And so, you know, I get to age 50 and I had none of

[00:12:30] Anke: [00:12:30] it. Yeah.

[00:12:32] Rennie: [00:12:32] You know, maybe, maybe 10% of the population can do that on their own without another human being.

[00:12:37] But one out of 10 is not a good statistic. Yeah,

[00:12:40] Anke: [00:12:40] that’s so true. And that’s probably where the kind of family background plays a role. If you come from a family where, you know, Your parents know how to deal with money, that you just kind of pick it up, you know, so that,

[00:12:56] Rennie: [00:12:56] yeah. And, and that’s pretty rare. I mean, parents can’t teach what they don’t know.

[00:13:02] And as a matter of fact, school teachers can’t teach what they’ve never learned and it’s not taught in school. So it’s not taught by parents. And, you know, people would stumble along trying to figure this out for themselves. And it’s mostly failure and not success.

[00:13:16] Anke: [00:13:16] Yeah, so true. So true. so tell me, what was your first business?

[00:13:20] What’s the first thing?

[00:13:23] Rennie: [00:13:23] Oh, no, I don’t see. The first thing I did was, Oh gosh. Oh. I w I was selling, machines that would press people’s clothing at home. And yeah, a friend of mine would put ads on TV. People would call in, I would go out to the house and I would, you know, entice them into buying.

[00:13:45] Something that hardly anyone ever needs. That’s where it started. And I said, you know what? This is not really long term. I’ve got to get into some business that I think will stick around for a long time. And I figured, well, money’s been on the planet for a long time. People gave up bartering centuries ago.

[00:14:05]money is probably a longterm thing. Okay. What do I do? So I started selling life insurance. And, you know, life insurance companies have been around for a hundred years. I figured they would still stick around and I was right, but I didn’t enjoy it. I did it. I was able to earn a living, but I really didn’t enjoy it.

[00:14:25] So that’s where the evolution started. it was, Oh, you talked,

[00:14:30] Anke: [00:14:30] you

[00:14:30] Rennie: [00:14:30] talked before the interview about the kinds of. Things we’d go after and we find out, find out we don’t like it. So I, I graduated from college as a school teacher. I did it for a year. I really enjoyed it, but it paid so poorly. I had to give it up.

[00:14:49] And so I thought, Oh, you know, I don’t like this. Insurance stuff. I don’t like selling insurance on. I’ve got an idea. I will build an agency and train other people to sell and I’ll support them and then I’ll get overrides on what they do. So that was it’s my idea. And within a couple of weeks of coming up with that idea, I had the opportunity.

[00:15:10] I need to build an insurance agency and, and started on that path and went out, insurance agents on their appointments to help them. You know, cell and I found out I hated it worse than selling on my own. You know, we’d be in someone’s house, they’re smoking cigarettes, I’m choking on it. And I can’t tell them, please don’t smoke in your own home, you know?

[00:15:42] And I’m out there with some person I really don’t care for and training them. And I’m thinking. This isn’t working. I gotta, you know, the point is I had an idea. I went for it, it showed up and I hated it, but you know what? We’re never going to run out of ideas.

[00:16:00] Anke: [00:16:00] Yeah. That’s so true.

[00:16:02] Rennie: [00:16:02] And so, you know, I can’t remember what I started afterwards, but it was not, Oh, I went into the pension administration business where I set up pensions for corporations and profit sharing plans and 401k plans for businesses.

[00:16:19] And then I became the director of pensions for an insurance company. And the funny part about that is it was the first time I left. Having control over my own income and became an employee. And I was probably somewhere in my thirties and. That was such a cushy situation. So glad they merged with another company and fired everybody on the fourth floor.

[00:16:45] So my, my life is, as an employee lasted about three or four months and I thought, Oh, this is perfect. I still have other opportunities. And so I went back into doing things on my own, but the reason I laughed, I think about myself as too insecure. To be an employee. Tell me about that.

[00:17:09] Anke: [00:17:09] Okay.

[00:17:10] Rennie: [00:17:10] Let’s say you’re an employee and you have a hundred percent of your income from one source.

[00:17:15] And that source decides they don’t like you anymore, or they go out of business or they lay you off or they for you for a yeah, like in a pandemic. I mean, gosh, in the, yeah. And States were up to like 40 million people non-employed because of the pandemic. Well, if these people were self employed, they could pivot and do something different in their business.

[00:17:35] But when they’re an employee, they just lost a hundred percent of their income. Yeah, they didn’t lose any percentage of their bills. They still owed their rent or their mortgage, or they want to buy groceries or make car payments or whatever, but they have no income now. But if, if I’m in business for myself and I lose a client or two, I lose a portion of my income.

[00:17:56] Not all of it. Yeah.

[00:17:58] Anke: [00:17:58] Yeah. Oh God. I couldn’t, I couldn’t agree more actually, when. When I decided to ditch my cushy, I job to go and move to different countries. Stop my own thing. One giant consideration was I wanted more job security and I didn’t want to, and you know that that’s the thing. People look at you as if you’re crazy.

[00:18:22] Why would you leave a permanent job too? You know, start something that who knows what turns that, that, what that turns into. But as you saying, like, I don’t want to shiver every time I hear the word restructuring project, you know, when you think, well, let’s let them shuffle around some departments and see whether we’ll still have employment after that, you know, because it isn’t even, it has nothing to do with whether you any good or not.

[00:18:50] Rennie: [00:18:50] That’s right. You can be wonderful. You’d still be out on the street.

[00:18:54] Anke: [00:18:54] Absolutely. And that was also the part where, you know, age comes in and I thought, well, I’m still, I’m still okay. Now, now I can still snap and call an agent or call a mate and somebody like I pick up a new project quickly, but also I don’t want to be, you know, 50 and send out resumes for programmers jobs.

[00:19:14] Rennie: [00:19:14] Right. Met some

[00:19:15] Anke: [00:19:15] 25 year old kid goes, we’ll get one thing here. You know,

[00:19:19] Rennie: [00:19:19] definitely I’ve got a tenant who just got a job in it with a large company, but it took him six months and he was homeless while he was trying to get this job. And I put him up for free and one of our apartment units, but the point is, You know, here’s someone who had the skills who couldn’t get a job.

[00:19:41] Why? Cause he was 60. Yeah. And he finally did land the job when the second person, well, he was their second choice after five months of interviews and their first choice said, I’m not waiting this long. Now that you’re offering it to me. It’s too late. I already accepted something else. He got it because he was the second choice and had had no other options.

[00:20:05] Anke: [00:20:05] No. Yeah.

[00:20:07] So

[00:20:08] Rennie: [00:20:08] it’ll be straight out to be a wonderful employee. I mean, a wonderful tenant. He’s paying rent now that he can. And I mean, it’s a completely different situation, but yeah, you don’t want to be going through that at age 60.

[00:20:20] Anke: [00:20:20] No, I mean, that’s the thing, but that, that illusion of security, I find it endlessly fascinating because at least if you’re out on your own, you have your, like at the helm of the boat, No, if you don’t like what’s going on, you can turn something somewhere else.

[00:20:38] Rennie: [00:20:38] Oh yeah. Like I was talking about at age 50, I had a, about 10 coaching clients paying me $5,500 a month. That it was my $5,000 a month, which meant if I lost a coaching client, I didn’t lose 5,000. I only lost 500. Yes,

[00:20:56] Anke: [00:20:56] absolutely.

[00:20:58] Rennie: [00:20:58] And TCO. And so then, you know, I could replace one client and, you know, after about.

[00:21:04] Well, I gave up one on one coaching because it just wasn’t that fulfilling to me after about 10 years. And you know, I, as the coaching clients dwindled off, I didn’t replace them, but that’s all it takes. Yeah. I would have been in control of my ship and I was, and you are, and that makes all the difference in the world.

[00:21:27] Oh,

[00:21:27] Anke: [00:21:27] for sure. So, okay. So when you let that the one on one clients know evaporate, so what was it that. So what’s the,

[00:21:40] Rennie: [00:21:40] that is the real estate, the reluctance apartment buildings. That’s right. It was those guys shift. Exactly. So it was sort of like, I don’t need to do this anymore. I’ve got more than enough income coming in from the apartment buildings.

[00:21:53]and so, Oh gosh, I guess it was about 10 years later. we’re nine to two, so, but eight, nine years later, it was a situation where I severed an Achilles tendon. And I couldn’t do anything. And I’m sitting at home calling a handyman to change the battery in a smoke alarm or change a light bulb for a tenant.

[00:22:17] And I’m thinking I’m going absolutely stir crazy.

[00:22:23] So I thought, you know, I’ve got to do something. What can I do? And that’s when I started in the online business, it was about six years ago. So that would have been about 2014 or so. And. I realized, well, what can I do? I can teach people how to handle money effectively. I can teach people how to do what I’ve done.

[00:22:44] I can teach people how to create a level of wealth. So they feel real good about donating to the causes that touch their heart and you know, why do I do it? Well, I almost walked away from it because you know, it involved the coaching and it was frustrating. I’m spending a lot of money learning this stuff and.

[00:23:04] Then this charity shelter to soldier was brought to my attention, said, now I’ve got a reason to do it. And so they get a hundred percent of the profits from my book, from my coaching, from my online programs. And that’s the reason I continue to do it. It’s to raise the money and donate it to the sh to the charity.

[00:23:24] Anke: [00:23:24] Yeah. I mean, that’s just. I think it’s that fulfillment that in the end of, at the end of the day, people are looking for, you know, it’s always like disguised, you know, want to make money. But I think at the end of it, it’s that fulfillment what everybody’s looking for. Yeah.

[00:23:40] Rennie: [00:23:40] It’s, it’s, it’s answering your heart’s calling and that’s what it’s about.

[00:23:46] That’s what provides the fulfillment.

[00:23:48] Anke: [00:23:48] Yeah. Yeah. So, so how is dealing online with clients? How do you find that? How is that different from, you know, basically real life in person

[00:24:01] Rennie: [00:24:01] it’s, it isn’t any different, in the same way that you might go to a BNI or some other kind of networking meeting or networking the chamber of commerce instead of going in person somewhere.

[00:24:13] You’re doing it online. I’m in several mastermind groups. I network with other people online and. You know, out of the connections that are created there, there are people who decide to come into my program. there are some people who want to connect with me on LinkedIn and sell me something. I connect with them and enroll them in my program instead.

[00:24:39] Anke: [00:24:39] Oh, that’s it. I have to teach that because it’s really funny how annoyed people getting, you know, when it’s like, Oh, let’s connect. And then next thing you know, they shove something down your throat.

[00:24:51] Rennie: [00:24:51] That’s the perfect opportunity. To say, how’s this working for you? What are you doing with your money? And I got to tell you, I find it fascinating because you know, so many of the people who want to sell me something are struggling financially and they belong in my program.

[00:25:07] Yeah. Oh, that

[00:25:08] Anke: [00:25:08] is funny. That is like, actually next time somebody tries to shove something down much of that. I’m going to send them

[00:25:15] Rennie: [00:25:15] to you. Well, I look at, yeah, I look at them as a prospect.

[00:25:20] Anke: [00:25:20] Yeah, absolutely. I mean, their

[00:25:22] Rennie: [00:25:22] prospects are coming. Yeah. Their, their prospects are coming to me through LinkedIn.

[00:25:26] Anke: [00:25:26] Yeah, absolutely. I mean, I think that’s the thing. It’s like, you have pretty much the whole world as your potential client, because nobody really knows how to, how to. Yeah, deal with money. Do you find there is a lot of, because I think there’s always two parts to, to an area of expertise like that, where it’s like this, the technical part of it, the mechanics of it, but then especially when it comes to money.

[00:25:54] Boy, that is a huge element of beliefs and kind of like, Oh, I’m kind of, you know, I would rather be a good person than have a lot of money. Like a lot of that kind of,

[00:26:05] Rennie: [00:26:05] Oh, Oh, you hit on my hot button. I’ve got a quote from Warren buffet. It’s my favorite quote of his. And he says, Of the billionaires I have known money just brings out the basic traits in them.

[00:26:22] If they were jerks before they had money, they were simply jerks with a billion dollars. And what that says is the opposite. It is true. A good person who becomes wealthy is still a good person. It’s not the money that corrupts anybody unless they were already corrupt.

[00:26:42] Anke: [00:26:42] Yeah.

[00:26:43] Rennie: [00:26:43] Yeah, well, because I get it so often from healers and I get it from coaches that, you know, I, I don’t want to have a lot of money cause that’ll make me a bad person.

[00:26:53] Well guess what? That’s the influence they got from society. That might’ve been the influence they got from their parents. I mean, I’ve had people tell me, their parents said, Oh, that person has got a lot of money. He must’ve done it illegally. He must have scammed other people. And that’s the belief that they inherit from their parents.

[00:27:12] And the reality is when you look around at Hollywood movies, when you look at TV shows, when you look at the scripture, when you look at books, when you look at fairy tales, all of them say. The poor people are the kind and noble and the wealthy people are the gradient heartless. And let me give you one example, you know, the story of Jack and the Beanstalk?

[00:27:34] No,

[00:27:34] Anke: [00:27:34] no, no.

[00:27:35] Rennie: [00:27:35] Okay. Alright. Cause yeah, I mean that was, that started and I was a European. Fairy tale and okay. Maybe in Germany.

[00:27:45] Anke: [00:27:45] Yeah, maybe. Yeah. Like in Germans called something different. So

[00:27:49] Rennie: [00:27:49] yeah. Oh yeah. It did have different names because it was translated into so many languages. But the story is that Jack, this poor child and his mom asks him to take a cow to market and sell it because they need money.

[00:28:02] So desperately. So he’s walking the couch to market and a man says, I’ve got these magic beans. I’ll trade them for the cow. So he goes home and yeah, it says, mom, look, I got these magic beams. Well, she’s ready to kill him. He just got rid of a whole cow for a pilot magic beans. She throws them out the window and the next morning, there’s this huge Beanstock that rises right up into the clouds.

[00:28:31] So Jack climbs at Beanstalk and he comes across a giant, a hides from the giant, but the giant has these golden eggs and he has a goose that lays these golden eggs and things of that nature. So Jack steals some golden eggs and climbs comes down to the Beanstalk and tells his mom look that it wasn’t a magic beans.

[00:28:51] It grew this Beanstalk and there was a giant in the heavens and I’ve brought back these golden eggs. So things are okay, he’s stealing golden eggs and it’s okay. Cause Jack is poor. Well, as the story continues, he steals the goose that lays the golden eggs. And as the giant is chasing him down the Beanstalk, he cuts it down and the giant falls to its death.

[00:29:15] Okay. So the moral of the story, which is not the one people are told, people are told, well, Jack was poor and it was okay to seal this stuff. The moral of the story in my mind is, excuse me, while I cough again,

[00:29:34] the moral in my mind is it’s okay to kill the rich. If you’re poor. Yeah. That’s what people pick up from the story subtly. And if you look at stories by Charles Dickens, if you look at the scripture, like a needle can pass through the eye, excuse me, a camel can pass through the eye of a needle easier than a rich man can get into heaven.

[00:29:59] What’s that telling you if you’re rich, you can’t go to heaven.

[00:30:02] Anke: [00:30:02] Yeah.

[00:30:03] Rennie: [00:30:03] These are the things that society imparts on the population that it’s better to be poor than it is to be rich. So of course, people are going to have a struggle when it comes to making money, because they’re going to see, well, I don’t want to be corrupt.

[00:30:18] I don’t want to be evil. I still want to get into heaven. I need to stay poor.

[00:30:25] Anke: [00:30:25] Yeah. Okay. I think that is, yeah, that is such a, like, you can really, it’s not hard to imagine how that would get in the way, wouldn’t it? Because when it comes to charging for your work or selling something, I think that’s where all that, all those hangups around selling come from.

[00:30:42] Rennie: [00:30:42] Absolutely. And it, I mean, Hollywood movies, like I said, perpetuate this myth, but if you think about it from the standpoint of what’s more effective, if Hollywood does a movie. Where the hero is rich and the poor people are awful. Are they going to sell more tickets or less tickets?

[00:31:03] Anke: [00:31:03] Yep. Well, I would imagine they’d sell less tickets because yeah, because nobody resonates.

[00:31:11] Nobody identifies with, with the hero in the story.

[00:31:16] Rennie: [00:31:16] Exactly. They’re more people who are gonna resonate with the poor people and they’re going to buy the tickets.

[00:31:22] Anke: [00:31:22] Yeah, absolutely. And it reminds me actually, there was, this precedent of oral, you know, and he was, you know, lovely guy, but I never liked that thing.

[00:31:32] That it was always like the fact that he lived like a poor man somehow made him a better person. Right. And I’m thinking, well, I don’t know. Like it isn’t. Yeah. I mean, money is just, I wish it’s like alcohol, it just kind of amplifies what’s already there. You know? So. Yeah. So I think you’ve got a huge, huge piece of work.

[00:31:54] You Chuck a work out

[00:31:55] Rennie: [00:31:55] for you there. Yeah. There are some people out there that could be clients. That’s true.

[00:32:01] Anke: [00:32:01] Yeah. So, so what’s on the horizon for you. Where are

[00:32:07] Rennie: [00:32:07] you headed? Well, my goal is to move from the number five, a donor of this charity to number one, that’s one of my goals. And you know, that just means I support more people to handle their money effectively, that I sell more books that I, that more people enroll in my program and that’ll provide more profits for me to donate to the charity and I’ll become their number one donor.

[00:32:34] Oh,

[00:32:34] Anke: [00:32:34] that’s beautiful. Now the logical follow on question is where can people find out about your books, your programs to help you achieve that goal?

[00:32:44] Rennie: [00:32:44] Well, I’ve got some great free stuff available, and if they just go to my website wealth on any income.com and put forward slash tools and the Al the number one, you know, like.

[00:32:58] Not spelling it out, but tools one, after wealth on any income.com, they will get a pile of free resources to help build their business, that they get to experience the stuff that I’ve got, the support to business owners. I’ve got a prerelease copy of it. My newest book called the attitudes of the wealthy cause you spoke about the attitudes to get in the way.

[00:33:22] And the first third of my award winning bestselling book. Deals with the attitudes to get in the way and how to get them out of the way. Oh, that’s

[00:33:30] Anke: [00:33:30] fabulous. Well, I’m going to put the link in the show notes, but I love that you spelled it out because sometimes people just listen to the call and they weren’t at the checkout, the Choate, the show notes.

[00:33:38] So that’s fabulous. That’s exciting. And there’s like, I’ve had a look there’s like loads of gold in there. So definitely.

[00:33:45] Rennie: [00:33:45] Yeah. I say there’s over a thousand dollars worth of free business building tools.

[00:33:52] Anke: [00:33:52] That’s fabulous. Thank you so much. There’s definitely people will love it because I’ve had sneak free preview.

[00:33:57] I had a little look and it’s yeah, amazingly generous and, super valuable. Thank you so much for coming. It was fascinating. I could talk to you for like the rest of the day.

[00:34:10] Rennie: [00:34:10] Yeah. And it’s so funny. I, I remember, someone who, who. Supports other people in creating podcasts say, how do you determine what topic you want to talk about?

[00:34:22] And he says, look at tables with people having different conversations. So they talking about, civil rights. Are they talking about decorating houses? Are they talking about money? What table are you going to be attracted to where you want to talk about whatever that topic is? And I realized, I love talking about money.

[00:34:40] Anke: [00:34:40] Yeah. That’s, that’s a, that’s a great exercise, isn’t it? Yeah. Yeah. And I think that also money is fascinating on so many different levels, so I don’t think you’ll, you’ll it’ll ever be boring.

[00:34:53] Rennie: [00:34:53] Yeah. From cryptocurrencies to, you know, mortgages to whatever it doesn’t make any difference. Yeah.

[00:35:01] Anke: [00:35:01] It’s a whole world out there.

[00:35:04] Well, thank you so much for coming and I’ll talk to you soon. Thank you.

[00:35:08] Rennie: [00:35:08] Thank you. My pleasure. I enjoyed talking to you. Okay. Bye bye. Thank

[00:35:13] Anke: [00:35:13] you. Bye bye.

[00:35:14] Thanks so much for listening If you enjoyed the episode please don’t forget to subscribe And if you know people who might enjoy it too please send them to fashion business

[00:35:26]

Curious How A Podcast Can Help You Grow YOUR Business?

Starting your podcast isn’t difficult, but there are a few things you need to do in the right order, and quite a few options to explore and decisions to be made for it to be a success.

In this FREE guide you'll get a birds eye view of what's involved - planning, recording, editing, publishing/promoting - so you can decide whether starting your own podcast is for you

Would you love to get more invitations to podcast interviews?

Being interviewed on podcasts is the quickest and 100% non-sleezy way to tell the world about your passion business.

But it’s not easy to get invited when you first start out. I know, I’ve been in your shoes, and I’m also a podcast host.

If you’d love to get more interviews the FREE “Top 5 Actionable Tips To Help You Get Podcast Interviews .. even if you’re just starting out” is for you. Check it out here.

Other Episodes You Might Enjoy

[powerpress_playlist category=”27″ limit=20]